The S&P Case-Shiller Home Price Indices are considered the leading measure of U.S. home prices. According to their most recent release, which covers data through the end of May, national home prices are up 4.5 percent year-over-year – which is down from 4.6 percent in the previous month's report. Craig J. Lazzara, managing director and global head of index investment strategy at S&P, says though home prices are still increasing, they may be rising at a slower rate than before. “In contrast with the past … [Read more...]

Demand For Purchase Loans Continues To Rise

According to the Mortgage Bankers Association's Weekly Applications Survey, demand for home purchase loans increased 2 percent last week and is now 19 percent higher than it was last year at the same time. The improvement comes during a week when average mortgage rates were mostly flat, with only rates for loans backed by the Federal Housing Administration seeing a significant drop. Overall, though, mortgage rates remain near all-time lows. Joel Kan, MBA's associate vice president of economic and industry … [Read more...]

Delayed Spring Buyers Become Summer Shoppers

At the beginning of the year, most analysts were predicting a hot spring sales season for the housing market. But in the wake of the coronavirus outbreak, a lot of prospective home buyers put their plans on hold. Now, it appears they're ready to buy. According to a new analysis, contract signings were up 15 percent month-over-month during the last week of June and the typical home for sale was sold in just 19 days. That's good news for the housing market, as it means spring's crashing sales numbers will likely see … [Read more...]

The Increasing Popularity Of Guest Dwellings

Accessory dwelling units (ADUs) are defined as secondary, self-contained housing units located on the same lot as a primary single-family home. In other words, guest houses, in-law apartments, garage apartments, and carriage houses. In most cases, these dwellings include a bathroom, kitchenette, living area, and a separate entrance. They're also increasingly popular among Americans living in regions where population growth and cost-of-living is on the rise. In fact, according to a newly released study from Freddie … [Read more...]

Mortgage Rates Continue Downward Trend

According to the Mortgage Bankers Association's Weekly Applications Survey, average mortgage rates fell again last week, with rates down for 30-year fixed-rate mortgages with conforming loan balances, loans backed by the Federal Housing Administration, and 15-year fixed-rate loans. Rates for jumbo loans were flat from the week before. The drop in rates led to a 12 percent increase in refinance activity. Purchase demand, on the other hand, was down for the week, though still 16 percent higher than last year at the … [Read more...]

Competition Rises As Summer Market Heats Up

When there are more home buyers than there are homes for sale, prices rise. Mostly, that's because buyers have to compete with each other for available homes by offering to pay more than the seller is asking. But while competition and bidding wars are good for home sellers, it can cause stress for buyers. That's why home shoppers in today's market need to be prepared. In most metros, buyer demand is high while the inventory of homes for sale is low. That means, a lot of hopeful home buyers are facing competition. … [Read more...]

Home Purchase Loans Up 33% From Last Year

According to the Mortgage Bankers Association's Weekly Applications Survey, demand for loans to buy homes is now 33 percent higher than it was at the same time last year. The improvement comes after another week-over-week increase. It also comes during a week when mortgage rates hit an all-time survey low. Joel Kan, MBA's associate vice president of economic and industry forecasting, says coronavirus news kept rates down. “Mortgage rates declined to another record low as renewed fears of a coronavirus resurgence … [Read more...]

Homes For Sale Are Selling Quickly

Buying a home takes a while. But though the process takes several weeks, you won't necessarily have a lot of time to deliberate once you've found a house you like. In most cases, you have to make an offer quickly or you'll risk losing the home to another buyer. That's because, in the current market, inventory is low. The number of homes for sale was already lower than normal before the coronavirus and, since the onset of the pandemic, it's fallen further. So, when you've found a house that fits your budget and … [Read more...]

Existing Home Sales Fall In May

Sales of previously owned homes fell in May, according to new numbers from the National Association of Realtors. Completed transactions were down 9.7 percent from the month before and 26.6 percent below last year at the same time. It was the third consecutive month of decreasing sales since the coronavirus' first impact in March. But despite the declines, Lawrence Yun, NAR's chief economist, is optimistic that things will rebound soon. “Sales completed in May reflect contract signings in March and April – during … [Read more...]

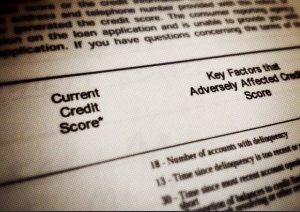

The Importance Of A Good Credit Score

Without credit, buying a house becomes much more difficult. After all, not many of us have enough money in the bank to be able to write a check for a couple hundred thousand dollars. And, if you can't pay cash, you'll need a loan. Which is why your credit score is so important. It's one of the ways a lender gets a feel for your financial habits and how responsible you are with your money. In short, your credit score will affect, not only the terms of the loan and your interest rate, but whether or not you even … [Read more...]

- « Previous Page

- 1

- …

- 93

- 94

- 95

- 96

- 97

- …

- 145

- Next Page »